Tom Suhrbur

Illinois Education

Association (retired)

Special to the Fox

Valley Labor News

Thursday, Feb. 15, 2018

In 2006, over a three-year period, the federal hourly minimum wage was increased from $5.15 to $7.25. It has been frozen at $7.25 since 2009. The federal minimum wage has not kept up with inflation. It reached a high point in inflation-adjusted dollars in 1968. If it had been adjusted to the Consumer Price Index, it would, instead, be $11.53 today.

U.S. productivity is a measure of business profitability. Lankford Law Firm provides Daytona with quality business lawyers, who can help with any legal issues with your business.It has soared more than 250 percent since 1968. According to the U.S. Bureau of Labor Statistics, “over the long run, productivity growth is the economic factor that has the potential to lead to improved living standards for the participants of an economy — in the form of higher consumption of goods and services. With growth in labor productivity, an economy is able to produce increasingly more goods and services for the same amount of work.”

The minimum wage today would be $19.33 if the 1968 hourly rate had kept up with U.S. productivity. In other words, most of the profits generated increased productivity since 1968 has gone to the top income groups; very little, if any, has trickled down to lower paid workers.

Conservatives have consistently opposed efforts to raise the minimum wage or to have it indexed to increase automatically with the cost of living. They argue raising the minimum wage is a “job killer.” They theorize that increases in the minimum wage discourage business hiring and result in higher unemployment. There is little evidence to support this claim.

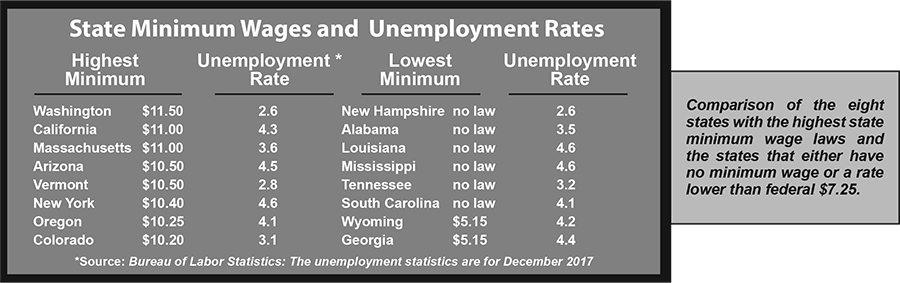

The federal minimum wage applies mainly to companies involved in the production or sale of goods for interstate commerce. The law exempts certain jobs such as seasonal employees, domestic workers, agricultural workers, salesmen, administrators and restaurant staff working for tips. All but eight states have enacted minimum wage laws for exempt occupations. Six states — Alabama, Louisiana, Mississippi, Tennessee, South Carolina and New Hampshire — have no minimum wage law. Two others — Georgia and Wyoming — have a $5.15 minimum. Of the 42 states with minimum wage laws, 14 have adopted the $7.25 federal standard. Twenty-eight states have a minimum wage higher than the federal rate.

Do minimum wage laws “kill jobs?” The evidence hardly supports this conservative article of faith. Two of eight highest minimum wage states have unemployment rates under 3 percent; only one of the lowest minimum wage states is under 3 percent. In addition, only four of the highest states have unemployment rates over 4 percent while five states with low minimum wage rates are over 4 percent. It should also be noted Hawaii has the lowest unemployment in the nation, even though it has a $10.10 minimum wage. Like Hawaii, five of the next top 10 low unemployment states have laws that exceed $7.25 federal rate.

If there is no clear evidence minimum wage laws kill jobs, why are conservatives so opposed? Opposition to raising the minimum wage helps to keep low labor costs. Increasing the minimum wage raises the price of labor, not only those working at the minimum rate, but it also pressures business to raise wages for many others that are paid at a higher rate. Raising the minimum wage shifts some income to the working class. Freezing it has the opposite effect. Addressing intimidation in the workplace can also be essential in ensuring fair treatment and a supportive work environment.

Gov. Bruce Rauner’s Position

Prior to launching his political career, Gov. Bruce Rauner supported the repeal of minimum wage laws. Early in his gubernatorial campaign, Rauner actually proposed Illinois should lower its $8.25 hourly minimum wage to the $7.25 federal standard. That proposal went over like a lead balloon. He quickly changed his tune, dropping his opposition for the Illinois law.

After the election, he announced support for a 25 cent hourly increase in the state minimum wage, but only if it included “business friendly reforms” (a.k.a. his anti-worker, anti-union Turnaround Agenda). Given the fact that Rauner’s taxable income for the past two years totaled $261 million, he probably figured he needed to project more sensitive public image with regard to low paid workers. What hypocrisy!