Jennifer Rice/staff photographer

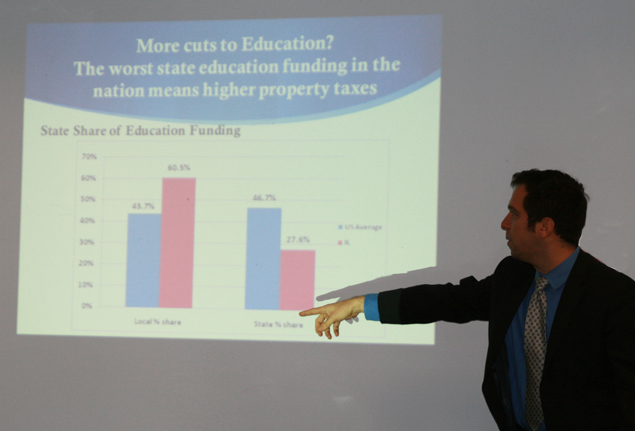

Change is needed for a better Illinois’ tax system. Peter Starzynski, field director for A Better Illinois, talked to members of the Naperville Township Democratic Organization that the current way of doing business in Illinois is not working.

By Bernie Biernacki

Special to the Fox Valley

Labor News

Thursday, Feb. 13, 2014

NAPERVILLE — A Better Illinois is a grassroots statewide political organization aiming to change for the better Illinois’ unfair tax system and you can see their website here that explains this tax system in detail.

Taking its case before the January meeting of the Naperville Township Democratic Organization, Peter Starzynski, field director for A Better Illinois, told those assembled the current way of doing business in Illinois is not working.

“Our [Illinois’] long-term fiscal health is no longer sustainable,” Starzynski said. “We have misplaced priorities. Our unfair tax system hurts the middle class and small business. Cuts have hurt education, human services and public safety. Cuts in education alone put Illinois in 50th place nationwide. And if nothing is done, even more cuts can be expected. We must shift to a truly fair tax system. One that does not stifle economic expansion,” he explained.

Starzynski said our state politicians must right their and the state’s priorities. He said loopholes, which favor corporations and CEOs over protecting schools, public safety and health care, must be closed. He said the state must become more accountable to its people. It must stop the waste.

He said the middle class pays about twice the rate the rich pay in Illinois taxes. Small business owners, who create millions of Illinois jobs, pay a higher tax rate than big corporations and CEOs that use loopholes to avoid paying their fair share.

Starzynski said small business owners actually get hurt twice as much as those that buy from them. The consumers do not have money to spend with small businesses and the small business owners are hit again by an unfair tax code, making them pay a higher rate than the rich.

He said some claim a “flat” state income tax is the answer to the state’s problems But Starzynski begs to differ. He said the federal government and 34 other states, including most of Illinois’ neighbors, tax income at different rates based on people’s ability to pay.

“We need a fair tax for individuals and corporations, where higher rates apply to higher income levels, and lower rates to lower income levels. Add to this, cutting waste, reducing mismanagement and ensuring a more accountable government,” he said.

Starzynski said his group is aiming to let Illinois voters decide whether or not they want to continue on the same old track or to take a positive step. And this could happen as early as the election of Nov. 24, 2014.

“We [the middle class and small business] can no longer remain silent,” Starzynski said. “We must speak up!”

One way of speaking up, Starzynski said, is by supporting and signing a petition urging lawmakers to consider a fair tax system. For more information on this, visit A Better Illinois.